For more than ten years now, investors have enjoyed the advantages of trading traditional funds in a regulated manner on the secondary market, thanks to the Sponsored Funds segment. Julius Baer acts as the market maker by making binding bid and ask prices available during exchange trading hours. Now, however, investors no longer have to wait until trading hours: starting in June 2024, Julius Baer is offering premarket trading in many mutual funds and exchange traded funds (ETFs) between

8.00 a.m. and 8.45 a.m. The range of products includes a broad investment universe of global underlyings, with the bank planning to add further instruments over time.

Exclusively in Switzerland, investors will find tradeable premarket quotes on selected mutual funds, ETFs and Swiss mid-cap stocks as well as on all SMI stocks.

How to place an order during premarket (8.00 a.m. – 8.45 a.m.):

- The order is placed by the relationship manager from the investor’s principal bank.

- The trading division of the investor’s principal bank must process the order via Julius Baer.

The premarket quotes are available from 8.00 a.m. to 8.45 a.m. at:

Julius Baer Derivates Portal Premarket

Julius Baer Swiss PreMarket app for iOS devices

Julius Baer Swiss PreMarket app for Android devices

Why is this segment called Sponsored Funds on BX Swiss and SIX Swiss Exchange?

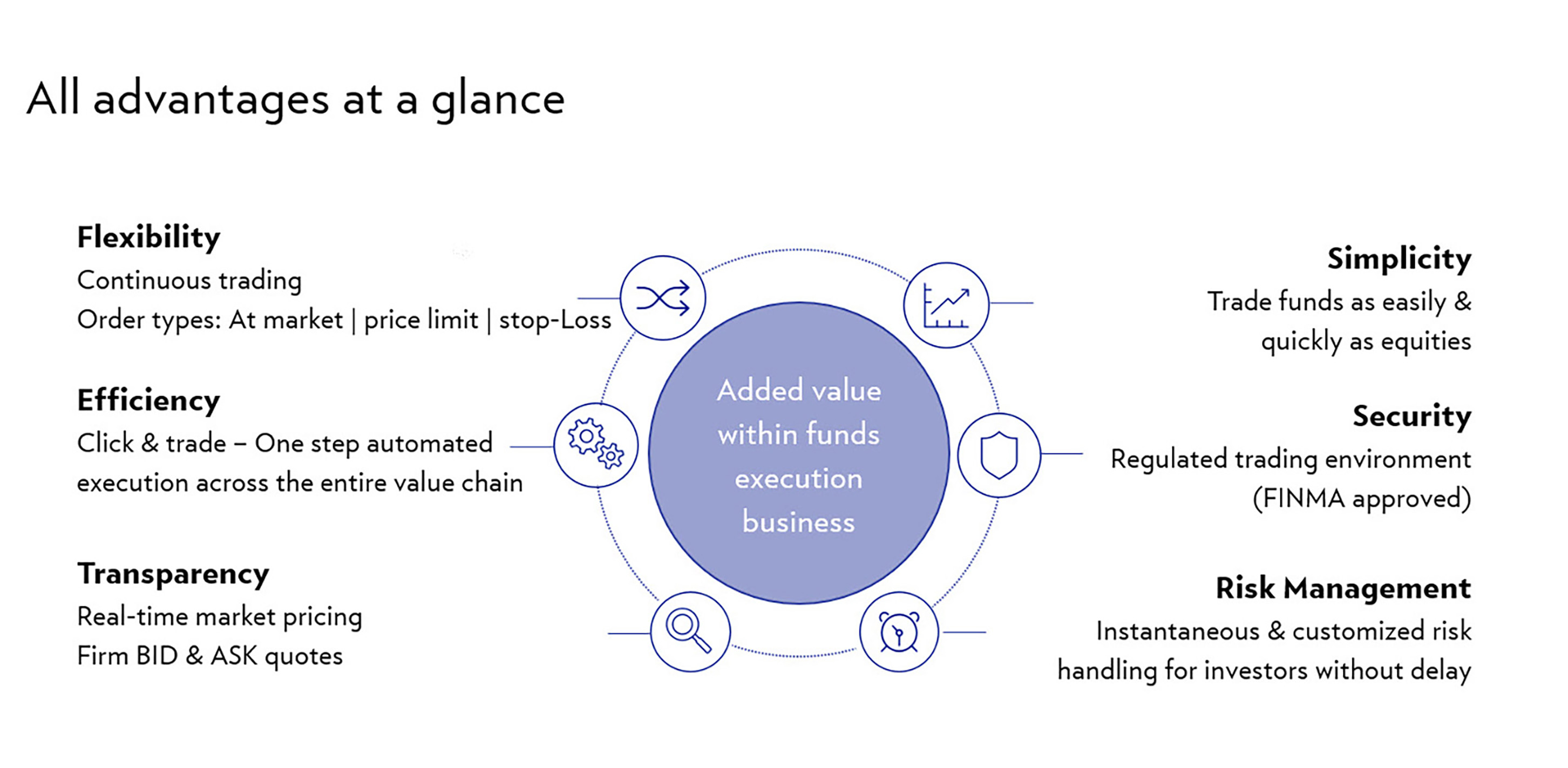

Sponsored Funds are traditional mutual funds that can be traded in real-time on the stock exchange. At the push of a button, investors can buy or sell more than 700 Sponsored Funds on SIX Swiss Exchange and more than 50 on BX Swiss – just like shares/ETFs or other financial instruments – with all the benefits of regulated and monitored trading.

Market makers, like Julius Baer, provide or ‘sponsor’ the liquidity, hence the name Sponsored Funds – and are responsible for ensuring that binding prices are available. SIX Swiss Exchange and BX Swiss continuously monitor trading to ensure that the buy and sell prices are in line with the market. This guarantees equal treatment of all market participants and provides the best possible protection for investors.

In this way, investors benefit from immediate order execution and can always react to the latest market changes. Executing orders for mutual funds in the traditional manner via the primary market (subscription and redemption of units at net asset value = NAV), on the other hand, involves delays due to the principle of forward pricing. The NAV price calculation takes place hours or days after the order to place the subscriptions and redemptions is accepted. This means that the investor only learns the execution price after the fact – one or two days later – and bears the market risk from the time the order is entered until it is executed.

In the case of trades made via the stock exchange, as with ETF trading, the bid-ask spread is much less important than the potential market volatility. That’s another reason transparent, standardised and fully automated trading of investment funds via the stock exchange offers significant benefits to all types of investors – from private clients to portfolio managers, institutional investors and independent asset managers.

How to place an order on the stock exchange during trading hours (9.00 a.m. – 5.30 p.m.):

- Orders can be placed as usual via the relationship manager or e-banking service of the investor’s principal bank.

- When submitting the order, it must be placed as a buy/sell order via the stock exchange (SIX Swiss Exchange/BX Swiss).

The latest bid and ask prices during trading hours are available from 9.00 a.m. to 5.30 p.m. at:

Julius Baer Derivatives Portal Mutual Funds

If you have any further questions, please do not hesitate to contact Bank Julius Baer’s Fund Trading team.

Phone: 058 888 87 66

E-mail: fundssecondary@juliusbaer.com